Here is everything you need to know about the upcoming week:

Mega-caps are reporting their earnings

Macroeconomic indicators

Federal Reserve Rate Hike & Bond Market

GDP Release

1. Mega-caps releasing their earnings: Five companies to rule them all:

Seven trillion dollars in market cap are on the line next week.

We got Apple, Microsoft, Alphabet (Google parent), Amazon, and Facebook all releasing their earnings reports.

Microsoft: $1.5 trillion in market cap

Apple: $2.5 trillion in market cap

Alphabet: $1.43 trillion in market cap

Amazon: $1.25 trillion in market cap

Facebook: $0.458 trillion in market cap

Here are expectations for the companies:

Microsoft, Earnings announcement Jul 26, 2022, after the market close:

On Jul 8th Piper Sandler lowered Microsoft’s estimate due to foreign exchange headwinds from the persistently strong U.S. dollar.

It expects to report between $51.94 billion and $52.74 billion in revenues for the quarter. The company had previously forecast fourth-quarter revenues in the range of $52.4 billion to $53.2 billion.

Microsoft also slightly cut its quarterly earnings forecast, saying it now expects to report adjusted earnings per share (EPS) in the range of $2.24 to $2.32. Previously, the company projected adjusted EPS between $2.28 and $2.35.

Apple, Earnings announcement Jul 28, 2022, after the market close:

According to Zacks Investment Research, based on 12 analysts' forecasts, the consensus EPS forecast for the quarter is $1.13. The reported EPS for the same quarter last year was $1.3. Analysts expect Q3 revenue of $82.8 billion, up 1.7% YoY. Morgan Stanley said Apple could get back on track and hit $3 trillion on its services shift.

Alphabet, Earnings announcement Jul 26, 2022, after the market close:

Alphabet (GOOGL) missed top & bottom line expectations in the last quarter due to a slowdown in the advertising market. Google expects to increase its revenues by 13.3% to $70.1 billion. EPS is expected to fall by 4.4% to $1.30.

Amazon, Earnings announcement Jul 28, 2022, after the market close:

Amazon has been on a streak recently. The wrong kind of streak, though. Disappointing investors. Revenues are expected to grow 6% to reach $119.5 billion. EPS is expected to get crushed due to inflationary pressures. Of course, AWS will be on focus.

Facebook, Earnings announcement Jul 27, 2022, after the market close:

According to Zacks Investment Research, based on ten analysts' forecasts, the consensus EPS forecast for the quarter is $2.51. The reported EPS for the same quarter last year was $3.61. Revenue is also forecast to dip 0.2% to $29.0 billion due to weaker advertiser demand and lower ad prices on Facebook and Instagram.

Daily active users and monthly active users numbers will be in focus. Market participants will also pay attention to how much money Facebook is willing to spend on its reality labs segment.

2. Macro Economic indicators:

First, let’s start by saying that the macro picture is not looking good.

A. PMI:

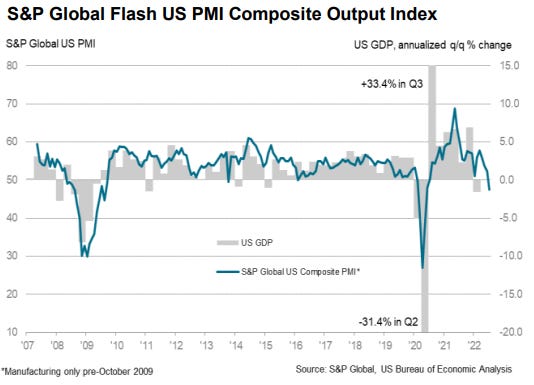

Flash US PMI Composite Output Index registered 47.5 in July, down notably from 52.3 in June, to signal a solid contraction in private sector output. The rate of decline was the sharpest since the initial stages of the pandemic in May 2020, as both manufacturers and service providers reported subdued demand conditions.

B. Philly Fed New Orders:

Philadelphia Fed Manufacturing Index is based on The Business Outlook Survey of manufacturers in the Third Federal Reserve District. Participants report the direction of change in overall business activity and the various measures of activity at their plants: employment, working hours, new and unfilled orders, shipments, inventories, delivery times, prices paid, and prices received.

Philadelphia Fed said Thursday its gauge of regional business activity dropped to negative 12.3 in July from negative 3.3 in the prior month.

Economists polled by the Wall Street Journal expected a 1.6 reading.

Any reading below zero indicates deteriorating conditions in the manufacturing sector. This is the second straight month in contraction territory.

C. Dr. Copper:

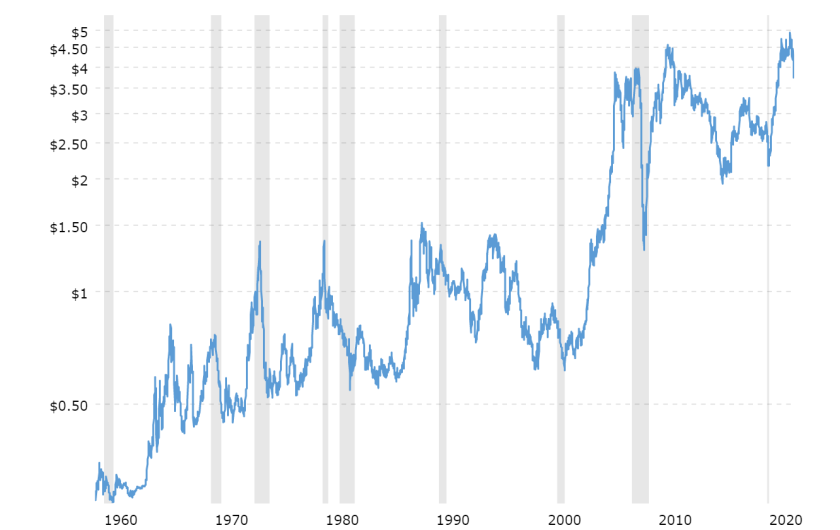

Copper (The commodity) predicts turning points in global economic cycles. The reason for that is because Copper is used in almost every sector. Demand for Copper is a reliable leading indicator of economic health. How do you gauge the demand? By looking at the price of Copper. Rising Copper prices indicate that demand for the commodity is strong, hence, a growing global economy. A decline in prices suggests the opposite. Copper had fallen into a bear market in the run-up to each of the last four recessions dating back to 1990, as the chart below shows. Copper fell into a bear market from its peak (-24%) in May 2021.

Grey areas indicate recessions.

D. Inverted Yield Curve

I explained much about the yield curve on all my social media platforms. You can find everything you need about yield curve shapes in this substack article.

The yield curve has inverted before each recession since 1955, with a recession following between six and 24 months, according to a 2018 report by researchers at the San Francisco Fed. And yes, the yield curve is inverted.

3. Federal Reserve Rate hikes, inflation, and expectations:

Currently, it seems like the Fed will stick to a 75 bps rate hike in July. In June inflation print was 9.1%, hitting 40 year high. Expectations were that the Fed would become more aggressive and hike rates by 100 bps (1%). Hawkish Fed members are supporting a 75 bps hike and not 100 bps.

4. GDP Release:

Gross Domestic Product will be released Thursday, July 28, 2022. Economists were expecting the U.S. economy to fall into recession somewhere in 2023. On July 1st, the Atlanta Fed GDP tracker showed that the U.S. economy might already be in a recession. The Atlanta Fed’s GDPNow gauge sees the second quarter at a negative 2.1%. Coupled with the first quarter’s decline of 1.6%, that would fit the technical definition of recession.

Thank you for reading. If you liked this article please leave a like it!

Amazing write-up on the coming week, thanks for sharing knowledge and bringing value👍

Thanks for the summary 🙏